Fascination About Kam Financial & Realty, Inc.

Fascination About Kam Financial & Realty, Inc.

Blog Article

About Kam Financial & Realty, Inc.

Table of ContentsThe Of Kam Financial & Realty, Inc.Some Known Details About Kam Financial & Realty, Inc. All About Kam Financial & Realty, Inc.10 Simple Techniques For Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Fundamentals ExplainedKam Financial & Realty, Inc. Things To Know Before You Get This

A home loan is a funding used to buy or preserve a home, story of land, or various other real estate.Mortgage applications undertake a strenuous underwriting process before they get to the closing stage. Home loan types, such as standard or fixed-rate finances, differ based on the debtor's requirements. Home mortgages are lendings that are made use of to buy homes and other kinds of realty. The residential or commercial property itself serves as security for the lending.

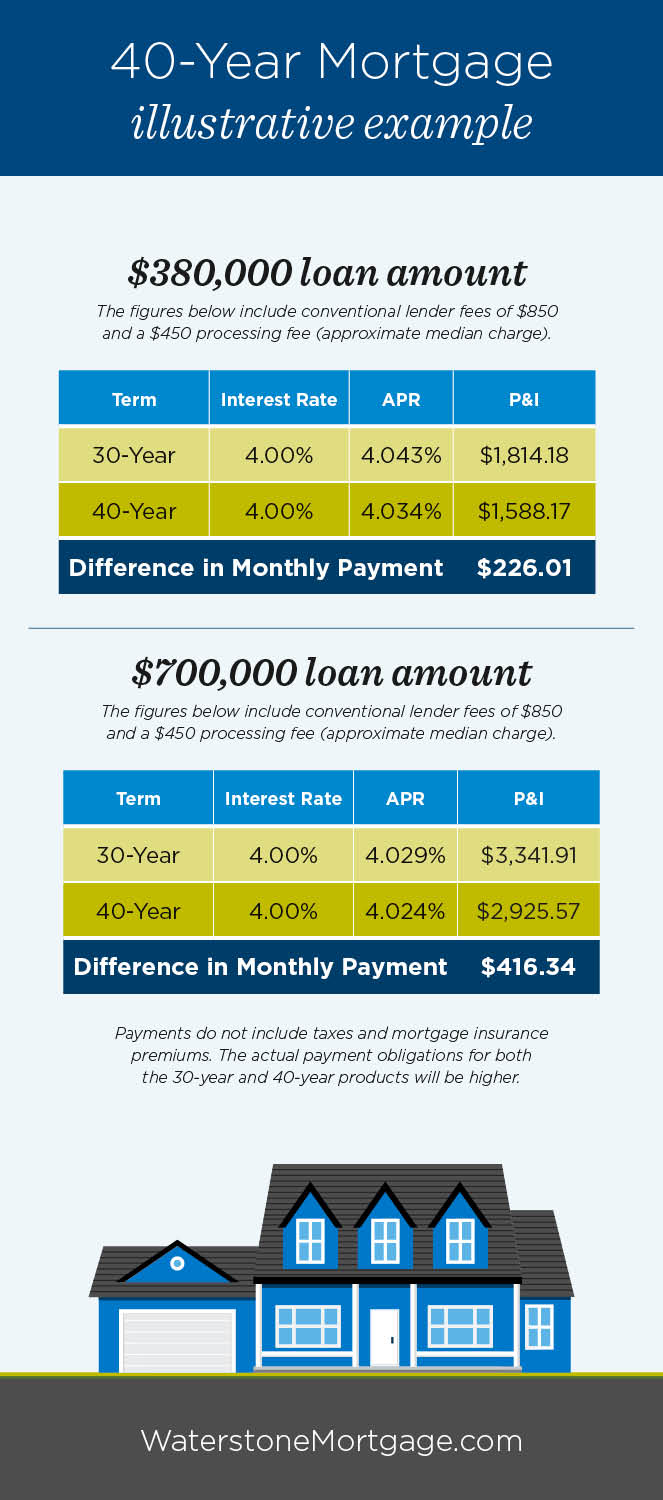

The cost of a home loan will rely on the sort of car loan, the term (such as three decades), and the interest price that the loan provider charges. Mortgage prices can differ widely depending on the kind of product and the certifications of the applicant. Zoe Hansen/ Investopedia Individuals and services use home loans to buy property without paying the whole purchase price upfront.

A Biased View of Kam Financial & Realty, Inc.

Many typical mortgages are fully amortized. Regular mortgage terms are for 15 or 30 years.

As an example, a household property buyer promises their residence to their lender, which after that has a case on the property. This ensures the loan provider's rate of interest in the property must the buyer default on their monetary responsibility. In the instance of foreclosure, the lender might force out the residents, offer the residential property, and make use of the money from the sale to pay off the home loan financial debt.

The lender will ask for evidence that the debtor is capable of paying off the loan. (http://tupalo.com/en/users/7908107)., and proof of existing work. If the application is accepted, the lending institution will certainly offer the debtor a lending of up to a particular amount and at a specific passion price.

The Best Guide To Kam Financial & Realty, Inc.

Being pre-approved for a home loan can give buyers a side in a limited real estate market because vendors will certainly know that they have the cash to support their deal. Once a buyer and vendor settle on the terms of their deal, they or their reps will satisfy at what's called a closing.

The seller will certainly move possession of the home to the buyer and receive the agreed-upon sum of cash, and the buyer will sign any kind of try this site remaining home loan records. There are hundreds of choices on where you can get a home loan.

Fascination About Kam Financial & Realty, Inc.

The common kind of mortgage is fixed-rate. With a fixed-rate home mortgage, the rate of interest stays the very same for the whole regard to the car loan, as do the customer's regular monthly payments toward the home loan. A fixed-rate mortgage is also called a traditional mortgage. With an adjustable-rate mortgage (ARM), the rate of interest is fixed for an initial term, after which it can alter periodically based upon dominating rates of interest.

The 10-Second Trick For Kam Financial & Realty, Inc.

The entire car loan equilibrium ends up being due when the borrower dies, moves away completely, or markets the home. Within each sort of home loan, borrowers have the choice to get discount points to get their rates of interest down. Points are basically a fee that debtors pay up front to have a lower rate of interest over the life of their loan.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

Exactly how a lot you'll need to pay for a mortgage depends on the type (such as repaired or flexible), its term (such as 20 or 30 years), any discount rate factors paid, and the rate of interest at the time. california mortgage brokers. Rates of interest can vary from week to week and from lending institution to loan provider, so it pays to look around

If you default and confiscate on your mortgage, nonetheless, the financial institution might end up being the brand-new owner of your home. The cost of a home is typically far higher than the quantity of cash that most homes conserve. Because of this, mortgages allow individuals and families to purchase a home by putting down just a reasonably tiny deposit, such as 20% of the purchase rate, and getting a finance for the equilibrium.

Report this page